Exhibit 99.1

Adaptimmune Reports Second Quarter Financial Results and Business Update

Substantial progress on the afami-cel BLA including FDA agreement on plan for confirmatory evidence and favorable feedback on commercial T-cell potency assay – submission now targeted for Q4 2023

Transition of lete-cel from GSK and data from the completed pivotal trial in synovial sarcoma and MRCLS expected in late 2023

Initiated Phase 2 SURPASS-3 trial in ovarian cancer, which has the potential to be registrational and is supported by RMAT designation

Completed strategic combination with TCR2 to form a pre-eminent cell therapy company adding pipeline, technologies, approximately 40 people and $84.6m in Total Liquidity1 at closing

Company confirms pipeline data readouts over the next 18 months

Cash runway into early 2026

Webcast to be held today, August 9, 2023, at 8:00 a.m. EDT (1:00 p.m. BST)

PHILADELPHIA, PA. and OXFORD, UK, August 9, 2023 – Adaptimmune Therapeutics plc (Nasdaq: ADAP), a leader in cell therapy to treat cancer, today reported financial results for the second quarter ended June 30, 2023 and provided a business update.

Adrian Rawcliffe, Adaptimmune’s Chief Executive Officer: “The BLA submission process for afami-cel is going well with alignment with the Agency on key de-risking items. We have completed most of the wet work and we are now focused on writing and publishing the remaining sections to complete Part 3 of this submission for approval of the first engineered T-cell therapy for a solid tumor indication. We have completed the combination with TCR2 and added pipeline assets, technologies, and increased our total liquidity by approximately $85m. The transition of lete-cel back from GSK is also progressing well. We have set ourselves up to make data-driven portfolio decisions to bring medicines to market that we have high conviction can make a real difference for people with cancer.”

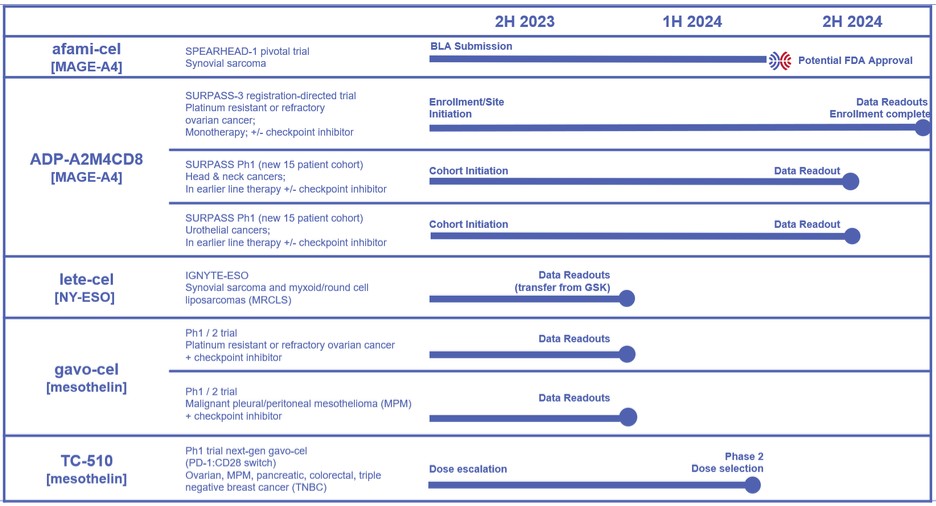

Pipeline update and overview of near- and mid-term catalysts to make rigorous data-driven investment decisions

Adaptimmune's lead clinical franchises utilize engineered T-cell therapies targeting MAGE-A4, NY-ESO (in process of transitioning from GSK), and mesothelin, which are expressed on a broad range of solid tumors. Use of these cell therapies is supported by compelling clinical data including results in late-stage synovial sarcoma which will form the basis of the Company's first BLA submission. The Company has an enhanced "next-gen toolbox" and preclinical pipeline including PRAME and CD70 programs.

The following figure provides an overview of pipeline data catalysts that will be used to make data-driven investment decisions. To view an enhanced version of this graphic, please visit: https://images.newsfilecorp.com/files/8845/168338_adptimage.jpg. Note, this figure was previously provided in the Adaptimmune corporate deck and a press release issued on June 1st to announce completion of the strategic combination with TCR2.