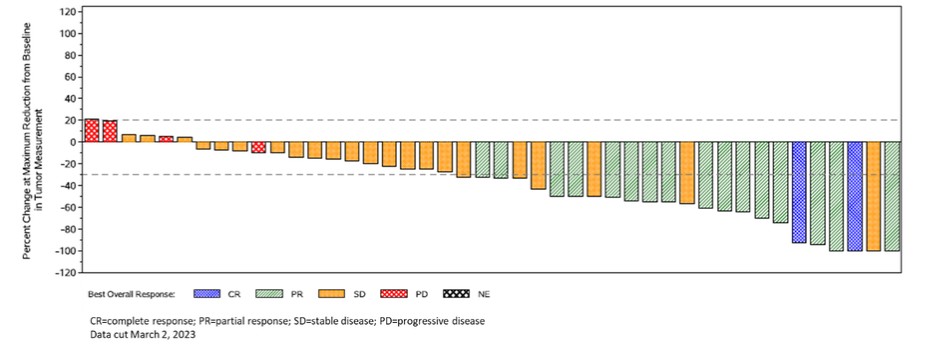

Responses by independent review from interim analysis of IGNYTE-ESO

| ● | SURPASS-3 Phase 2 Trial with ADP-A2M4CD8 targeting MAGE-A4. A Phase 2 trial for people with platinum resistant ovarian cancer has been initiated. We have received RMAT designation (Regenerative Medicine Advanced Therapy designation) for ADP-A2M4CD8 for the treatment of this indication from the FDA. In the Phase 1 SURPASS trial an ORR of 40% in ovarian cancer (6/15 people treated) was reported at the European Society for Medical Oncology (“ESMO”) in October 2023, with one complete response and 5 partial responses. The Phase 2 trial will evaluate ADP-A2M4CD8 in both monotherapy and in combination with a checkpoint inhibitor, nivolumab, in platinum resistant ovarian cancer. |

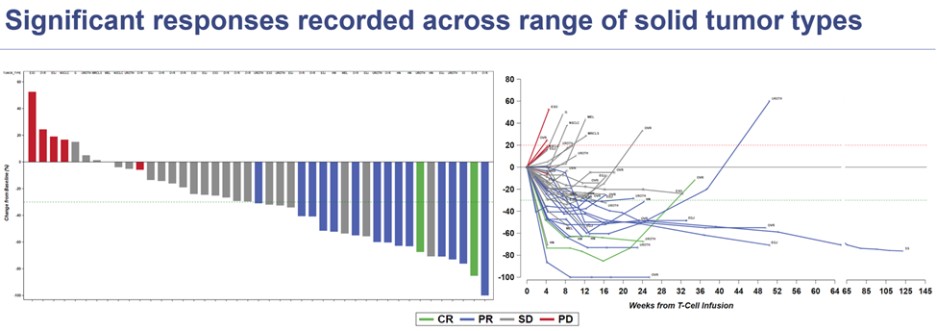

An earlier stage clinical trial is ongoing with our MAGE-A4 targeted TCR-T-cell therapy (ADP-A2M4CD8).

| ● | SURPASS Phase 1 Trial with ADP-A2M4CD8: Enrolment is ongoing in a Phase 1 trial for ADP-A2M4CD8, focusing on treatment of patients with head and neck and urothelial cancers in which the MAGE-A4 antigen is expressed and in earlier line treatment settings. Updated data from the trial was presented in October 2023 at ESMO. Across all indications the trial reported an overall response rate of 35%. In the 26 patients with ovarian, urothelial and head and neck cancers the response rate is 50% and in patients who received 3 or fewer prior lines of therapy, the response rate increases to 75%. The trial includes a combination cohort where participants receive a combination of ADP-A2M4CD8 together with a checkpoint inhibitor (nivolumab). Early data from the combination cohort was presented at ESMO in October 2023 and is still evolving. As of August 14, 2023 one patient in the combination cohort had a confirmed response. Subsequent to the data cut off, there has been one additional confirmed response. |

CR=complete response; PR=partial response; SD=stable disease; PD=progressive disease; ESMO 2023 data cut off August 14, 2023

27