UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the quarterly period ended March 31, 2019

|

|

|

|

|

|

OR

|

|

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 001-37368

ADAPTIMMUNE THERAPEUTICS PLC

(Exact name of Registrant as specified in its charter)

|

|

|

|

England and Wales

|

Not Applicable

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

60 Jubilee Avenue, Milton Park

Abingdon, Oxfordshire OX14 4RX

United Kingdom

(44) 1235 430000

(Address of principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer☒

|

Accelerated filer☐

|

|

Non-accelerated filer☐

|

Smaller reporting company☐

|

|

|

Emerging growth company☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standard provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

|

|

|

|

American Depositary Shares, each representing 6 Ordinary Shares, par value £0.001 per share

|

ADAP

|

The Nasdaq Global Select Market

|

As of May 2, 2019, the number of outstanding ordinary shares par value £0.001 per share of the Registrant is 628,357,300.

General information

In this Quarterly Report on Form 10‑Q (“Quarterly Report”), “Adaptimmune,” the “Group,” the “Company,” “we,” “us” and “our” refer to Adaptimmune Therapeutics plc and its consolidated subsidiaries, except where the context otherwise requires.

Information Regarding Forward-Looking Statements

This Quarterly Report contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. All statements other than statements of historical fact in this Quarterly Report are forward-looking statements.

These forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause our actual results of operations, financial condition, liquidity, performance, prospects, opportunities, achievements or industry results, as well as those of the markets we serve or intend to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. These forward-looking statements are based on assumptions regarding our present and future business strategies and the environment in which we expect to operate in the future. Important factors that could cause those differences include, but are not limited to:

|

·

| |

our ability to successfully advance our ADP-A2M10 (MAGE-A10), ADP-A2M4 (MAGE-A4) and ADP-A2AFP (AFP) products through clinical development and the timing within which we can recruit patients and treat patients in our clinical trials; |

|

·

| |

our ability to successfully and reproducibly manufacture SPEAR T-cells in order to meet patient demand; |

|

·

| |

our ability to further develop our commercial manufacturing process for our SPEAR T-cells, transfer such commercial process to third party contract manufacturers, if required, and for such third party contract manufacturers or ourselves to manufacture SPEAR T-cells to the quality and on the timescales we require; |

|

·

| |

the scope and timing of performance of our ongoing collaboration with GlaxoSmithKline (“GSK”); |

|

·

| |

our ability to successfully advance our SPEAR T-cell technology platform to improve the safety and effectiveness of our existing SPEAR T-cell candidates and to submit Investigational New Drug Applications, or INDs, for new SPEAR T-cell candidates; |

|

·

| |

the rate and degree of market acceptance of T-cell therapy generally, and of SPEAR T-cells; |

|

·

| |

government regulation and approval, including, but not limited to, the expected regulatory approval timelines for SPEAR T-cells and the level of pricing and reimbursement for SPEAR T-cells, if approved for marketing; |

|

·

| |

the existence of any third party patents preventing further development of any SPEAR T-cells, including, any inability to obtain appropriate third party licenses, or enforcement of patents against us or our collaborators; |

|

·

| |

our ability to obtain granted patents covering any SPEAR T-cells and to enforce such patents against third parties; |

|

·

| |

volatility in equity markets in general and in the biopharmaceutical sector in particular; |

|

·

| |

fluctuations in the price of materials and bought-in components; |

|

·

| |

our relationships with suppliers, contract manufacturing organizations or CROs and other third-party providers including fluctuations in the price of materials and services, ability to obtain reagents particularly where such reagents are only available from a single source, and performance of third party providers; |

|

·

| |

increased competition from other companies in the biotechnology and pharmaceutical industries including where such competition impacts ability to recruit patients in to clinical trials; |

|

·

| |

claims for personal injury or death arising from the use of SPEAR T-cell candidates; |

|

·

| |

our ability to attract and retain qualified personnel; and |

|

·

| |

additional factors that are not known to us at this time. |

Additional factors that could cause actual results, financial condition, liquidity, performance, prospects, opportunities, achievements or industry results to differ materially include, but are not limited to, those discussed under “Risk Factors” in Part II, Item 1A in this Quarterly Report and in our other filings with the Securities and Exchange Commission (the “SEC”). Additional risks that we may currently deem immaterial or that are not presently known to us could also cause the forward-looking events discussed in this Quarterly Report not to occur. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify estimates and forward-looking statements. Estimates and forward-looking statements speak only at the date they were made, and we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Our future results may differ materially from those expressed in these estimates and forward-looking statements. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this Quarterly Report might not occur, and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, inclusive of, but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements.

ADAPTIMMUNE THERAPEUTICS PLC

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

December 31,

|

|

|

|

2019

|

|

2018

|

|

Assets

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

49,917

|

|

$

|

68,379

|

|

Marketable securities - available-for-sale debt securities

|

|

|

118,241

|

|

|

136,755

|

|

Accounts receivable, net of allowance for doubtful accounts of $0 and $0

|

|

|

—

|

|

|

192

|

|

Other current assets and prepaid expenses (including current portion of clinical materials)

|

|

|

32,143

|

|

|

25,769

|

|

Total current assets

|

|

|

200,301

|

|

|

231,095

|

|

|

|

|

|

|

|

|

|

Restricted cash

|

|

|

4,473

|

|

|

4,097

|

|

Clinical materials

|

|

|

3,972

|

|

|

3,953

|

|

Operating lease right-of-use assets, net of accumulated amortization of $656 (2018: $0)

|

|

|

24,462

|

|

|

—

|

|

Property, plant and equipment, net of accumulated depreciation of $18,083 (2018: $15,924)

|

|

|

35,703

|

|

|

36,118

|

|

Intangibles, net of accumulated amortization of $1,411 (2018: $1,218)

|

|

|

1,529

|

|

|

1,473

|

|

Total assets

|

|

$

|

270,440

|

|

$

|

276,736

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

5,391

|

|

|

4,083

|

|

Operating lease liabilities, current

|

|

|

2,217

|

|

|

—

|

|

Accrued expenses and other accrued liabilities

|

|

|

15,827

|

|

|

20,354

|

|

Total current liabilities

|

|

|

23,435

|

|

|

24,437

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities, non-current

|

|

|

26,779

|

|

|

—

|

|

Other liabilities, non-current

|

|

|

571

|

|

|

5,414

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

50,785

|

|

|

29,851

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

Common stock - Ordinary shares par value £0.001, 701,103,126 authorized and 628,294,702 issued and outstanding (2018: 701,103,126 authorized and 627,454,270 issued and outstanding)

|

|

|

940

|

|

|

939

|

|

Additional paid in capital

|

|

|

577,722

|

|

|

574,208

|

|

Accumulated other comprehensive loss

|

|

|

(13,096)

|

|

|

(9,763)

|

|

Accumulated deficit

|

|

|

(345,911)

|

|

|

(318,499)

|

|

Total stockholders' equity

|

|

|

219,655

|

|

|

246,885

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

270,440

|

|

$

|

276,736

|

See accompanying notes to unaudited condensed consolidated financial statements.

ADAPTIMMUNE THERAPEUTICS PLC

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

March 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

Revenue

|

|

$

|

—

|

|

$

|

8,196

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

(22,019)

|

|

|

(25,732)

|

|

|

General and administrative

|

|

|

(11,773)

|

|

|

(11,204)

|

|

|

Total operating expenses

|

|

|

(33,792)

|

|

|

(36,936)

|

|

|

Operating loss

|

|

|

(33,792)

|

|

|

(28,740)

|

|

|

Interest income

|

|

|

952

|

|

|

659

|

|

|

Other income, net

|

|

|

5,430

|

|

|

7,130

|

|

|

Loss before income taxes

|

|

|

(27,410)

|

|

|

(20,951)

|

|

|

Income taxes

|

|

|

(2)

|

|

|

(127)

|

|

|

Net loss attributable to ordinary shareholders

|

|

$

|

(27,412)

|

|

$

|

(21,078)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per ordinary share - Basic and diluted

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

(0.04)

|

|

$

|

(0.04)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

627,945,243

|

|

|

562,381,995

|

|

See accompanying notes to unaudited condensed consolidated financial statements.

ADAPTIMMUNE THERAPEUTICS PLC

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

March 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

Net loss

|

|

$

|

(27,412)

|

|

$

|

(21,078)

|

|

|

Other comprehensive loss, net of tax

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments, net of tax of $0 and $0

|

|

|

(3,543)

|

|

|

(2,602)

|

|

|

Unrealized gains (losses) on available-for-sale debt securities

|

|

|

|

|

|

|

|

|

Unrealized holding gains (losses) on available-for-sale debt securities, net of tax of $0 and $0

|

|

|

210

|

|

|

(4,056)

|

|

|

Reclassification adjustment for losses on available-for-sale debt securities included in net income, net of tax of $0 and $0

|

|

|

—

|

|

|

1,163

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss for the period

|

|

$

|

(30,745)

|

|

$

|

(26,573)

|

|

See accompanying notes to unaudited condensed consolidated financial statements.

ADAPTIMMUNE THERAPEUTICS PLC

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGE IN EQUITY

(In thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

comprehensive loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

unrealized

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

gains

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

foreign

|

|

(losses) on

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

currency

|

|

available-for-

|

|

|

|

|

Total

|

|

|

|

Common

|

|

Common

|

|

paid in

|

|

translation

|

|

sale debt

|

|

Accumulated

|

|

stockholders'

|

|

|

|

stock

|

|

stock

|

|

capital

|

|

adjustments

|

|

securities

|

|

deficit

|

|

equity

|

|

Balance as of 1 January 2019

|

|

627,454,270

|

|

$

|

939

|

|

$

|

574,208

|

|

$

|

(9,607)

|

|

$

|

(156)

|

|

$

|

(318,499)

|

|

$

|

246,885

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(27,412)

|

|

|

(27,412)

|

|

Issuance of shares upon exercise of stock options

|

|

840,432

|

|

|

1

|

|

|

35

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

36

|

|

Foreign currency translation adjustments

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(3,543)

|

|

|

—

|

|

|

—

|

|

|

(3,543)

|

|

Unrealized holding gains on available-for-sale debt securities, net of tax of $0

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

210

|

|

|

—

|

|

|

210

|

|

Share-based compensation expense

|

|

—

|

|

|

—

|

|

|

3,479

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

3,479

|

|

Balance as of March 31, 2019

|

|

628,294,702

|

|

$

|

940

|

|

$

|

577,722

|

|

$

|

(13,150)

|

|

$

|

54

|

|

$

|

(345,911)

|

|

$

|

219,655

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

comprehensive loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

unrealized

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

gains

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

foreign

|

|

(losses ) on

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

currency

|

|

available-for-

|

|

|

|

|

Total

|

|

|

|

Common

|

|

Common

|

|

paid in

|

|

translation

|

|

sale debt

|

|

Accumulated

|

|

stockholders’

|

|

|

|

stock

|

|

stock

|

|

capital

|

|

adjustments

|

|

securities

|

|

deficit

|

|

equity

|

|

Balance as of 1 January 2018 (under previous guidance)

|

|

562,119,334

|

|

$

|

854

|

|

$

|

455,401

|

|

$

|

(17,867)

|

|

$

|

(3,774)

|

|

$

|

(231,630)

|

|

$

|

202,984

|

|

Cumulative effect of applying new accounting standards

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

8,645

|

|

|

8,645

|

|

Balance as of 1 January 2018 (adjusted)

|

|

562,119,334

|

|

|

854

|

|

|

455,401

|

|

|

(17,867)

|

|

|

(3,774)

|

|

|

(222,985)

|

|

|

211,629

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(21,078)

|

|

|

(21,078)

|

|

Issuance of shares upon exercise of stock options

|

|

2,740,626

|

|

|

4

|

|

|

1,530

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,534

|

|

Other comprehensive loss before reclassifications

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(2,602)

|

|

|

—

|

|

|

—

|

|

|

(2,602)

|

|

Unrealized holding losses on available-for-sale debt securities, net of tax of $-

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(4,056)

|

|

|

—

|

|

|

(4,056)

|

|

Reclassification from accumulated other comprehensive income of losses on available-for-sale debt securities included in net income, net of tax of $-

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,163

|

|

|

—

|

|

|

1,163

|

|

Share-based compensation expense

|

|

—

|

|

|

—

|

|

|

4,672

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

4,672

|

|

Balance as of March 31, 2018

|

|

564,859,960

|

|

$

|

858

|

|

$

|

461,603

|

|

$

|

(20,469)

|

|

$

|

(6,667)

|

|

$

|

(244,063)

|

|

$

|

191,262

|

See accompanying notes to unaudited condensed consolidated financial statements.

ADAPTIMMUNE THERAPEUTICS PLC

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

March 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(27,412)

|

|

$

|

(21,078)

|

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

1,828

|

|

|

1,740

|

|

|

Amortization

|

|

|

167

|

|

|

143

|

|

|

Share-based compensation expense

|

|

|

3,479

|

|

|

4,672

|

|

|

Realized loss on available-for-sale debt securities

|

|

|

—

|

|

|

1,163

|

|

|

Unrealized foreign exchange gains

|

|

|

(5,095)

|

|

|

(7,862)

|

|

|

Other

|

|

|

(39)

|

|

|

124

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

Increase in receivables and other operating assets

|

|

|

(6,659)

|

|

|

(10,179)

|

|

|

Increase in non-current operating assets

|

|

|

(19)

|

|

|

(123)

|

|

|

Decrease in payables and deferred revenue

|

|

|

(2,453)

|

|

|

(15,879)

|

|

|

Net cash used in operating activities

|

|

|

(36,203)

|

|

|

(47,279)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

Acquisition of property, plant and equipment

|

|

|

(904)

|

|

|

(1,904)

|

|

|

Acquisition of intangibles

|

|

|

(205)

|

|

|

(10)

|

|

|

Maturity or redemption of marketable securities

|

|

|

22,669

|

|

|

28,043

|

|

|

Investment in marketable securities

|

|

|

(3,904)

|

|

|

(12,490)

|

|

|

Net cash provided by investing activities

|

|

|

17,656

|

|

|

13,639

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options

|

|

|

36

|

|

|

1,534

|

|

|

Net cash provided by financing activities

|

|

|

36

|

|

|

1,534

|

|

|

|

|

|

|

|

|

|

|

|

Effect of currency exchange rate changes on cash, cash equivalents and restricted cash

|

|

|

425

|

|

|

1,545

|

|

|

Net decrease in cash and cash equivalents

|

|

|

(18,086)

|

|

|

(30,561)

|

|

|

Cash, cash equivalents and restricted cash at start of period

|

|

|

72,476

|

|

|

88,296

|

|

|

Cash, cash equivalents and restricted cash at end of period

|

|

$

|

54,390

|

|

$

|

57,735

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to unaudited condensed consolidated financial statements.

ADAPTIMMUNE THERAPEUTICS PLC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — General

Adaptimmune Therapeutics plc is registered in England and Wales. Its registered office is 60 Jubilee Avenue, Milton Park, Abingdon, Oxfordshire, OX14 4RX, United Kingdom. Adaptimmune Therapeutics plc and its subsidiaries (collectively “Adaptimmune” or the “Company”) is a clinical-stage biopharmaceutical company primarily focused on providing novel cell therapies to patients, particularly for the treatment of solid tumors. The Company’s proprietary SPEAR (Specific Peptide Enhanced Affinity Receptor) T-cell platform enables it to identify cancer targets, find and genetically engineer T-cell receptors (“TCRs”), and produce therapeutic candidates (“SPEAR T-cells”) for administration to patients. Using its affinity engineered TCRs, the Company aims to become the first company to have a TCR T-cell approved for the treatment of a solid tumor indication.

The Company is subject to a number of risks similar to other biopharmaceutical companies in the early stage of clinical development including, but not limited to, the need to obtain adequate additional funding, possible failure of preclinical programs or clinical programs, the need to obtain marketing approval for its SPEAR T-cells, competitors developing new technological innovations, the need to successfully commercialize and gain market acceptance of the Company’s SPEAR T-cells, the need to develop a suitable commercial manufacturing process and protection of proprietary technology. If the Company does not successfully commercialize any of its SPEAR T-cells, it will be unable to generate product revenue or achieve profitability. The Company had an accumulated deficit of $345.9 million as of March 31, 2019.

Note 2 — Summary of Significant Accounting Policies

(a) Basis of presentation

The condensed consolidated interim financial statements of Adaptimmune Therapeutics plc and its subsidiaries and other financial information included in this Quarterly Report are unaudited and have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) and are presented in U.S. dollars. All significant intercompany accounts and transactions between the Company and its subsidiaries have been eliminated on consolidation.

The unaudited condensed consolidated interim financial statements presented in this Quarterly Report should be read in conjunction with the consolidated financial statements and accompanying notes included in the Company’s Annual Report on Form 10-K filed with the SEC on February 27, 2019 (the “Annual Report”). The balance sheet as of December 31, 2018 was derived from audited consolidated financial statements included in the Company’s Annual Report but does not include all disclosures required by U.S. GAAP. The Company’s significant accounting policies are described in Note 2 to those consolidated financial statements.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted from these interim financial statements. However, these interim financial statements include all adjustments, consisting only of normal recurring adjustments, which are, in the opinion of management, necessary to fairly state the results of the interim period. The interim results are not necessarily indicative of results to be expected for the full year.

On January 1, 2019, the Company adopted new guidance on lease recognition, which has been codified within Accounting Standard Codification Topic 842, Leases (“ASC 842”). The comparative financial information for the three months ended March 31, 2018 and as of December 31, 2018 has not been restated. The Company has adopted the guidance using the modified retrospective approach, with the cumulative effect of initially applying the guidance recognized as an adjustment to the opening balance of equity at January 1, 2019. Therefore, the comparative information has not been adjusted and continues to be reported under previous guidance. The effect on the accumulated deficit, total stockholders’ equity and net assets as at January 1, 2019 was $0.

Note 2 — Summary of Significant Accounting Policies (continued)

(b) Use of estimates in interim financial statements

The preparation of interim financial statements, in conformity with U.S. GAAP and SEC regulations, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of revenues and expenses during the reporting period. Estimates and assumptions are primarily made in relation to the valuation of share options, valuation allowances relating to deferred tax assets, revenue recognition, estimating clinical trial expenses and estimating reimbursements from R&D tax and expenditure credits. If actual results differ from the Company’s estimates, or to the extent these estimates are adjusted in future periods, the Company’s results of operations could either benefit from, or be adversely affected by, any such change in estimate.

(c) Foreign currency

The reporting currency of the Company is the U.S. dollar. The Company has determined the functional currency of the ultimate parent company, Adaptimmune Therapeutics plc, is U.S. dollars because it predominately raises finance and expends cash in U.S. dollars. The functional currency of subsidiary operations is the applicable local currency. Transactions in foreign currencies are translated into the functional currency of the subsidiary in which they occur at the foreign exchange rate in effect on at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies at the balance sheet date are translated into the functional currency of the relevant subsidiary at the foreign exchange rate in effect on the balance sheet date. Foreign exchange differences arising on translation are recognized within other income (expense) in the consolidated statement of operations.

The results of operations for subsidiaries, whose functional currency is not the U.S. dollar, are translated at an average rate for the period where this rate approximates to the foreign exchange rates ruling at the dates of the transactions and the balance sheet are translated at foreign exchange rates ruling at the balance sheet date. Exchange differences arising from this translation of foreign operations are reported as an item of other comprehensive income (loss).

(d) Fair value measurements

The Company is required to disclose information on all assets and liabilities reported at fair value that enables an assessment of the inputs used in determining the reported fair values. The fair value hierarchy prioritizes valuation inputs based on the observable nature of those inputs. The hierarchy defines three levels of valuation inputs:

Level 1 - Quoted prices in active markets for identical assets or liabilities

Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly

Level 3 - Unobservable inputs that reflect the Company's own assumptions about the assumptions market participants would use in pricing the asset or liability

The carrying amounts of the Company’s cash and cash equivalents, restricted cash, accounts receivable, accounts payable and accrued expenses approximate fair value because of the short-term nature of these instruments. The fair value of marketable securities, which are measured at fair value on a recurring basis is detailed in Note 6, Fair value measurements.

Note 2 — Summary of Significant Accounting Policies (continued)

(e) Going concern

Management considers that there are no conditions or events, in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going concern for a period of at least one year from the date of the condensed consolidated interim financial statements. This evaluation is based on relevant conditions and events that are known and reasonably knowable at the date that:

a. The Company’s current financial condition, including its liquidity sources;

b. The Company’s conditional and unconditional obligations due or anticipated within one year;

c. The funds necessary to maintain the Company’s operations considering its current financial condition,

obligations, and other expected cash flows; and

d. Other conditions and events, when considered in conjunction with the above that may adversely affect the

Company’s ability to meet its obligations.

(f) New accounting pronouncements

Adopted in the period

Leases

In February 2016, the Financial Accounting Standards Board (“FASB”) issued a new standard, ASC 842, related to leases to increase transparency and comparability among organizations by requiring the recognition of “Right of Use” (“ROU”) assets and lease liabilities on the balance sheet. Most prominent among the changes in the standard is the recognition of ROU assets and lease liabilities by lessees for those leases classified as operating leases. Under the standard, disclosures are required to meet the objective of enabling users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases.

The Company has adopted the guidance using the modified retrospective approach, with the cumulative effect of initially applying the guidance recognized as an adjustment to the opening balance of equity at January 1, 2019. Therefore, the comparative information has not been adjusted and continues to be reported under previous guidance. The Company elected the package of practical expedients permitted under the transition guidance within the new standard, which among other things, allowed it to carry forward the historical lease classification. The Company also elected the practical expedient related to land easements, allowing it to carry forward our accounting treatment for land easements on existing agreements. Therefore, the effect on the accumulated deficit, total stockholders’ equity and net assets as at January 1, 2019 was $0.

The adoption of ASC 842 has had a material impact on the Company’s financial statements due to the following:

|

·

| |

As a lessee, the Company has recognized liabilities for operating leases following the adoption date. These liabilities have been measured at the present value of the remaining minimum rental payments using an incremental borrowing rate (the rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term for an amount equal to the lease payments in a similar economic environment). |

|

·

| |

The Company’s operating lease agreements under the new standards also required the measurement of ROU assets at the initial measurement of the lease liabilities, with adjustments for prepaid or accrued lease payments and the remaining balance of any incentives received (the amount of the gross lease incentives received net of amounts recognized previously as part of the single lease cost). |

Note 2 — Summary of Significant Accounting Policies (continued)

(f) New accounting pronouncements (continued)

Adopted in the period (continued)

Leases (continued)

|

·

| |

Following initial measurement of the operating lease liabilities and ROU assets, the lease liabilities experience further changes with the accrual of interest and the repayments made under the lease agreements. In addition, the ROU assets are amortized at amounts equal to the difference between the straight-line lease expense and the change in interest on the lease liability in the period. |

The Company has operating leases in relation to property and laboratory facilities. Leases with an expected term of 12 months or less at inception are not recorded on the balance sheet and are instead recognized as a lease expense on a straight-line basis over the lease. term. The Company accounts for lease components (e.g. fixed payments including rent and termination costs) separately from the non-lease components (e.g. common-area maintenance costs and service charges based on utilization) which are recognized over the period in which the obligation occurs.

The lease term and minimum lease payments have been determined by taking the non-cancellable period and then assessing the reasonable certainty of whether to exercise an option to extend or terminate. Economic factors such as termination costs have been considered in this assessment. All of the leases have termination options and, with the exception of one of the two buildings in Milton Park, UK, the assumption has been made that the initial termination option will be activated. For Milton Park, the two buildings are assumed to have a coterminous termination point. The maximum lease term without activation of termination options is to 2041. Where termination options have been assumed to be utilized, the associated termination fees have been included in the calculation of the lease liability and ROU asset.

All leases are classified as operating leases, and the related cash flows are categorized under Net cash used in operating activities. For the three months ended March 31, 2019 the operating lease cash outflows totaled $1.2 million, and the operating lease cost, recognized in General and administrative expenses, totaled $1.0 million. In addition, there were costs in relation to short term leases of $951,000.

Amounts reported in the unaudited condensed consolidated balance sheet as of 31 March, 2019 were (in thousands):

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

2019

|

|

|

Operating lease right of use assets

|

|

$

|

24,462

|

|

|

Operating lease liabilities, current

|

|

|

(2,217)

|

|

|

Operating lease liabilities, non-current

|

|

|

(26,779)

|

|

|

Total operating lease liabilities

|

|

$

|

(4,534)

|

|

The maturities of operating lease liabilities are as follows (in thousands):

|

|

|

|

|

|

|

|

|

Operating leases

|

|

|

|

|

|

|

|

2019

|

|

$

|

2,465

|

|

|

2020

|

|

|

4,136

|

|

|

2021

|

|

|

4,172

|

|

|

2022

|

|

|

4,216

|

|

|

2023

|

|

|

3,936

|

|

|

after 2023

|

|

|

16,520

|

|

|

Total lease payments

|

|

|

35,445

|

|

|

Less: Imputed interest

|

|

|

6,449

|

|

|

Present value of lease liability

|

|

$

|

28,996

|

|

Note 2 — Summary of Significant Accounting Policies (continued)

(f) New accounting pronouncements (continued)

Adopted in the period (continued)

Leases (continued)

The company has no external borrowings, therefore the discount rates have been determined as an average rate for each lease, as provided by independent financial institutions. The rates provided were based upon the Company’s incremental borrowing rate for each lease based upon the value, currency and term. The weighted average discount rate for the operating leases as at March 31, 2019 is 4.65% and the weighted average remaining lease term is 8.1 years.

To be adopted in future periods

Measurement of Credit Losses on Financial Instruments

In June 2016, the FASB issued ASU 2016-13 - Financial Instruments - Credit losses, which replaces the incurred loss impairment methodology for financial instruments in current GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The guidance is effective for the fiscal year beginning January 1, 2020, including interim periods within that fiscal year. Early application is permitted for the fiscal year beginning January 1, 2019, including interim periods within that fiscal year. The guidance must be adopted using a modified-retrospective approach and a prospective transition approach is required for debt securities for which an other-than-temporary impairment had been recognized before the effective date. The Company is currently evaluating the impact of the guidance on its consolidated financial statements.

Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract

In August 2018, the FASB issued ASU 2018-15 – Intangibles — Goodwill and Other — Internal-Use Software (Subtopic 350-40) Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract, which aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software (and hosting arrangements that include an internal use software license). The guidance is effective for the fiscal year beginning January 1, 2020, including interim periods within that fiscal year. Early application is permitted for the fiscal year beginning January 1, 2019, including interim periods within that fiscal year. The guidance may be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption. The Company is currently evaluating the impact of the guidance on its consolidated financial statements.

Changes to the Disclosure Requirements for Fair Value Measurement

In August 2018, the FASB issued ASU 2018-13 – Fair Value Measurement (Topic 820) - Disclosure Framework— Changes to the Disclosure Requirements for Fair Value Measurement, which modifies the disclosure requirements on fair value measurements in Topic 820, Fair Value Measurement. The guidance is effective for the fiscal year beginning January 1, 2020, including interim periods within that fiscal year. Early application is permitted. Certain amendments apply prospectively with the all other amendments applied retrospectively to all periods presented upon their effective date. The Company is currently evaluating the impact of the guidance on its consolidated financial statements.

Note 2 — Summary of Significant Accounting Policies (continued)

(g)Restricted cash

The Company’s restricted cash consists primarily of cash providing security for letters of credit in respect of lease agreements.

(h) Accumulated other comprehensive income (loss)

The following amounts were reclassified out of other comprehensive income during the three months ended March 31, 2019 and 2018 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount reclassified

|

|

|

|

|

Three months ended

|

|

Three months ended

|

|

|

|

|

|

March 31,

|

|

March 31,

|

|

|

|

Component of Accumulated Other Comprehensive Income

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains (losses) on available-for-sale securities

|

|

|

|

|

|

|

|

|

|

Reclassification adjustment for losses on available-for-sale debt securities

|

|

$

|

—

|

|

$

|

1,163

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 3 — Revenue

There has been no revenue in the quarter, and there is no deferred revenue balance at March 31, 2019 or at December 31, 2018. There has been no movement in deferred revenue in the current period.

The Company has one contract with a customer, which is the GSK Collaboration and License Agreement. The GSK Collaboration and License Agreement consists of multiple performance obligations. Following the completion of the NY-ESO SPEAR T-cell transition program and the termination of the PRAME pre-clinical development program in 2018, GSK has nominated its third target under the Collaboration and License Agreement. However, work has not commenced on this target and as such, no revenue has been recognized for the three months ended March 31, 2019. Future revenues will depend on the progress of the development programs within the Collaboration and License Agreement, and GSK’s progress with the NY-ESO program, which are difficult to predict.

Note 4 — Other income, net

Other income, net consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

March 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

Realized foreign exchange gains

|

|

$

|

295

|

|

$

|

—

|

|

|

Unrealized foreign exchange gains

|

|

|

5,095

|

|

|

7,862

|

|

|

Losses on redemption or maturity of available-for-sale debt securities

|

|

|

—

|

|

|

(1,163)

|

|

|

Other

|

|

|

40

|

|

|

431

|

|

|

|

|

$

|

5,430

|

|

$

|

7,130

|

|

Note 5 — Loss per share

The numerator for the basic and diluted income (loss) per share is as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

March 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

Net income (loss) attributable to ordinary shareholders

|

|

$

|

(27,412)

|

|

$

|

(21,078)

|

|

|

Numerator for basic income (loss) per share

|

|

|

(27,412)

|

|

|

(21,078)

|

|

|

Numerator for diluted income (loss) per share

|

|

|

(27,412)

|

|

|

(21,078)

|

|

The denominator for the basic and diluted income (loss) per share is as follows:

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

March 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

Denominator for basic income (loss) per share - Weighted average shares outstanding

|

|

627,945,243

|

|

562,381,995

|

|

|

Effect of dilutive securities:

|

|

|

|

|

|

|

Employee stock options

|

|

103,848,778

|

|

89,203,915

|

|

|

Denominator for diluted income (loss) per share

|

|

731,794,021

|

|

651,585,910

|

|

The dilutive effect of 103,848,778 and 89,203,915 stock options have been excluded from the diluted loss per share calculation for the three months ended March 31, 2019 and 2018, respectively, because they would have an antidilutive effect on the loss per share for the period.

Note 6 — Fair value measurements

Assets and liabilities measured at fair value on a recurring basis based on Level 1, Level 2, and Level 3 fair value measurement criteria as of March 31, 2019 are as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value measurements using

|

|

|

|

March 31,

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketable securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate debt securities

|

|

$

|

109,252

|

|

$

|

109,252

|

|

$

|

—

|

|

$

|

—

|

|

Agency bond

|

|

|

3,995

|

|

|

—

|

|

|

3,995

|

|

|

—

|

|

Treasury bills

|

|

|

1,992

|

|

|

—

|

|

|

1,992

|

|

|

—

|

|

Certificate of deposit

|

|

|

3,002

|

|

|

—

|

|

|

3,002

|

|

|

—

|

|

|

|

$

|

118,241

|

|

$

|

109,252

|

|

$

|

8,989

|

|

$

|

—

|

The Company estimates the fair value of available-for-sale debt securities with the aid of a third party valuation service, which uses actual trade and indicative prices sourced from third-party providers on a daily basis to estimate the fair value. If observed market prices are not available (for example securities with short maturities and infrequent secondary market trades), the securities are priced using a valuation model maximizing observable inputs, including market interest rates.

Note 7 — Available-for-sale debt securities

As of March 31, 2019, the Company has the following investments in available-for-sale debt securities (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross

|

|

Gross

|

|

Aggregate

|

|

|

|

|

|

Amortized

|

|

Unrealized

|

|

Unrealized

|

|

Estimated

|

|

|

|

Maturity

|

|

cost

|

|

Gains

|

|

Losses

|

|

Fair Value

|

|

Cash equivalents:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate debt securities

|

|

Less than 3 months

|

|

$

|

7,990

|

|

$

|

—

|

|

$

|

—

|

|

$

|

7,990

|

|

|

|

|

|

$

|

7,990

|

|

$

|

—

|

|

$

|

—

|

|

$

|

7,990

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketable securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate debt securities

|

|

3 months to 1 year

|

|

$

|

109,203

|

|

$

|

64

|

|

$

|

(15)

|

|

$

|

109,252

|

|

Agency bond

|

|

3 months to 1 year

|

|

|

3,990

|

|

|

5

|

|

|

—

|

|

|

3,995

|

|

Treasury bills

|

|

3 months to 1 year

|

|

|

1,992

|

|

|

—

|

|

|

—

|

|

|

1,992

|

|

Certificate of deposit

|

|

3 months to 1 year

|

|

|

3,002

|

|

|

—

|

|

|

—

|

|

|

3,002

|

|

|

|

|

|

$

|

118,187

|

|

$

|

69

|

|

$

|

(15)

|

|

$

|

118,241

|

In the three months ended March 31, 2019, there were no realized losses recognized on the maturity of available-for-sale debt securities.

As of March 31, 2019 and December 31, 2018, the aggregate fair value of securities held by the Company in an unrealized loss position was $49,567,000 and $117,179,000, respectively, which consisted of 15 and 37 securities, respectively. No securities have been in an unrealized loss position for more than one year. As of March 31, 2019, the securities in an unrealized loss position are not considered to be other than temporarily impaired because the impairments are not severe, have been for a short duration and are due to normal market fluctuations. Furthermore, the Company does not intend to sell the debt securities in an unrealized loss position and it is unlikely that the Company will be required to sell these securities before the recovery of the amortized cost.

Note 8 — Other current assets

Other current assets consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

December 31,

|

|

|

|

2019

|

|

2018

|

|

Corporate tax receivable

|

|

$

|

22,072

|

|

$

|

16,459

|

|

Prepayments

|

|

|

8,284

|

|

|

6,279

|

|

Clinical materials

|

|

|

862

|

|

|

1,087

|

|

VAT receivable

|

|

|

416

|

|

|

1,505

|

|

Other current assets

|

|

|

509

|

|

|

439

|

|

|

|

$

|

32,143

|

|

$

|

25,769

|

Note 9 — Accrued expenses and other current liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

December 31,

|

|

|

|

2019

|

|

2018

|

|

Accrued clinical & development expenditure

|

|

$

|

9,432

|

|

$

|

9,637

|

|

Accrued employee expenses

|

|

|

4,069

|

|

|

7,553

|

|

Accrued rent and property expenses

|

|

|

—

|

|

|

426

|

|

Other accrued expenditure

|

|

|

2,027

|

|

|

2,422

|

|

Other

|

|

|

299

|

|

|

316

|

|

|

|

$

|

15,827

|

|

$

|

20,354

|

Note 10 — Share-based compensation

The following table shows the total share-based compensation expense included in the unaudited consolidated statements of operations (thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

|

|

|

|

|

March 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

|

Research and development

|

|

$

|

2,021

|

|

$

|

2,554

|

|

|

|

General and administrative

|

|

|

1,458

|

|

|

2,118

|

|

|

|

|

|

$

|

3,479

|

|

$

|

4,672

|

|

|

There were 10,807,200 and 9,994,656 options over ordinary shares granted in the three months ended March 31, 2019 and 2018 respectively, with a weighted average fair value of $0.55 and $0.75, respectively. Additionally, in the three months ended March 31, 2019 and 2018, 6,498,126 and 6,552,636 options were granted respectively, which have a nominal exercise price (similar to a restricted stock unit (RSU)), with a weighted average fair value of $0.94 and $1.34, respectively.

The RSU-style options over ordinary shares in Adaptimmune Therapeutics plc were granted under the Adaptimmune Therapeutics plc Employee Share Option Scheme (adopted on January 14, 2016). These options have an exercise price equal to the nominal value of an ordinary share, of £0.001, and generally vest over four years, with 25% on the first, and each subsequent, anniversary of the grant date. The RSU-style options are not subject to performance conditions and the contractual term is ten years. The Company has elected to account for forfeitures of stock options when they occur by reversing compensation cost previously recognized, in the period the award is forfeited, for an award that is forfeited before completion of the requisite service period.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The statements in this discussion regarding industry outlook, our expectations regarding our future performance, liquidity and capital resources and other non-historical statements are forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the risks and uncertainties described in “Risk Factors” and “Forward-Looking Statements” in this Quarterly Report. Our actual results may differ materially from those contained in or implied by any forward-looking statements.

The following discussion should be read in conjunction with the unaudited consolidated financial statements and accompanying notes included elsewhere in this Quarterly Report and our consolidated financial statements and accompanying notes included within our Annual Report.

We are a clinical-stage biopharmaceutical company focused on novel cancer immunotherapy products based on our proprietary SPEAR T-cell platform. We have developed a proprietary platform that enables us to identify cancer targets, find and genetically engineer TCRs, and produce TCR therapeutic candidates (“SPEAR T-cells”) for administration to patients. We engineer TCRs to increase their affinity to cancer specific peptides in order to destroy cancer cells in patients.

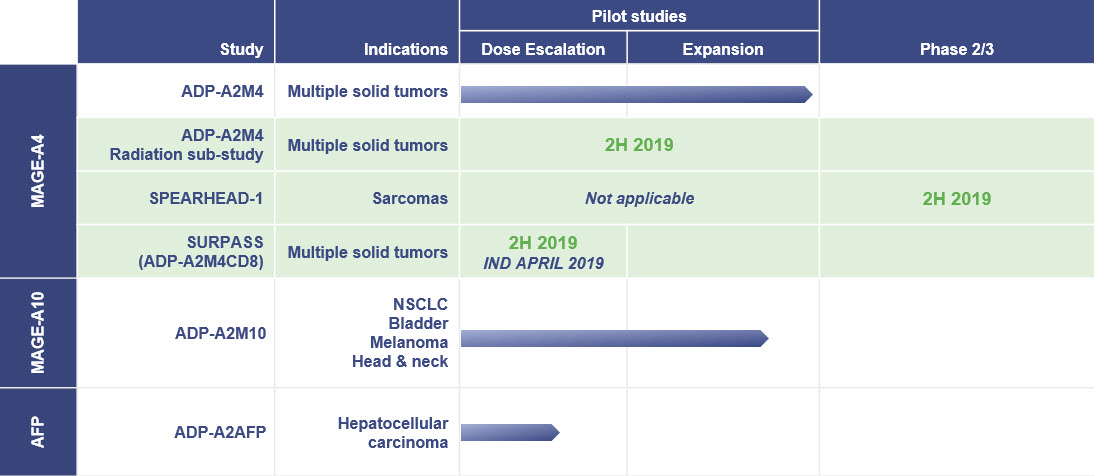

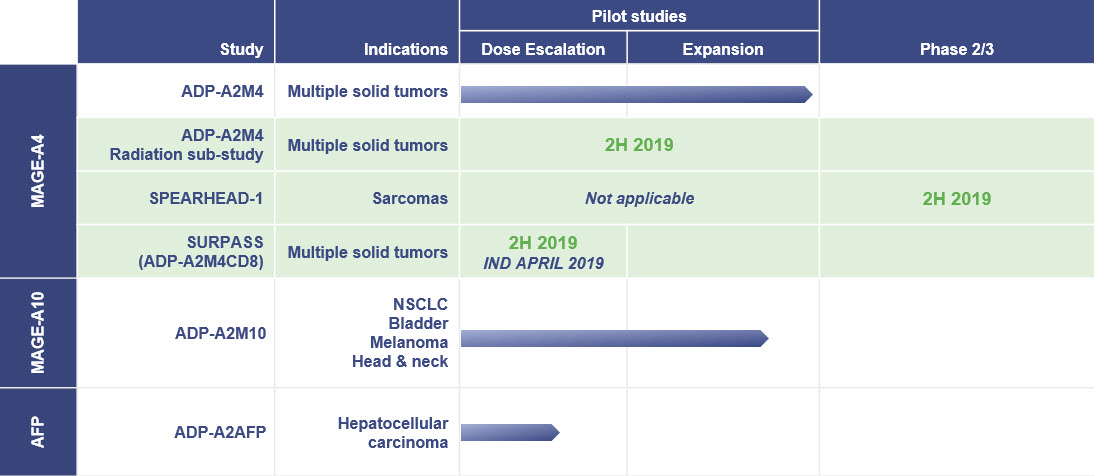

Clinical Pipeline

We have Phase 1 clinical trials ongoing with our wholly owned ADP-A2M10, ADP-A2M4 and ADP-A2AFP SPEAR T-cells in a total of ten solid tumor types including non-small cell lung cancer (“NSCLC”), head and neck cancer, ovarian, urothelial, melanoma, hepatocellular, esophageal, gastric, synovial sarcoma and myxoid round cell lyposarcoma (“MRCLS”) cancers. An Investigational New Drug (“IND”) application has also been filed for a clinical trial for a next generation SPEAR T-cell ADP-A2M4CD8. The current clinical trial pipeline is illustrated below.

A Phase 1 clinical trial is ongoing in nine tumor indications, namely urothelial, melanoma, head and neck, ovarian, NSCLC, esophageal and gastric cancers, synovial sarcoma and MRCLS. This trial is a first-in-human, open-label study utilizing a modified 3+3 design in up to 30 patients at a selected dose with escalating target doses of 100 million (Cohort 1), 1 billion (Cohort 2), 5 billion (Cohort 3), and up to 10 billion (Expansion Phase) transduced SPEAR T-cells to evaluate safety. Patients are currently being enrolled in the Expansion Phase of the trial.

|

·

| |

To date, ADP-A2A4 has exhibited a favorable safety profile with no evidence of toxicity related to off-target binding or alloreactivity, and most adverse events were consistent with those experienced by cancer patients undergoing chemotherapy or other immunotherapies. |

|

·

| |

As of April 30, 2019, 10 patients with synovial sarcoma had been treated in either Cohort 3 or the Expansion Phase of the trial. Four patients have achieved a partial response (one partial response (PR) being unconfirmed). A best overall response of stable disease was reported in three patients and one patient had a best overall response of progressive disease (PD). The remaining two patients have not been assessed. |

|

·

| |

We have treated 7 patients in indications other than synovial sarcoma in Cohort 3 and the Expansion Phase of the trial and as of April 30, 2019 have seen evidence of anti-tumor activity in a melanoma patient (with best overall response of PD) and an ovarian patient (with best overall response of SD). We continue to research the mechanisms of tumor resistance applicable to these indications to facilitate development of next generation SPEAR T-cells. |

|

·

| |

A radiation sub-study is planned to be added to the ADP-A2M4 study. This will be a site-specific study at MD Anderson Cancer Centre and is assessing the impact of low dose radiation in connection with administration of our SPEAR T-cells. |

Given the responses seen with synovial sarcoma patients, we are planning to start a Phase 2 clinical trial in synovial sarcoma and myxoid round cell liposarcoma indications with a total of 60 patients. The trial (“SPEARHEAD 1”) is targeted to open during 2019 in sites in the United States, Canada and Europe.

Given the evidence of anti-tumor activity seen in indications other than synovial sarcoma with ADP-A2M4 and while we continue to evaluate the translational data, we have filed an IND for a next generation SPEAR T-cell, ADP-A2M4CD8. This next generation SPEAR T-cell utilizes the same engineered TCR as ADP-A2M4 but with the addition of a CD8α homodimer. The addition of the CD8α homodimer has been shown in vitro to increase cytokine release, increase SPEAR T-cell potency and promote epitope spreading. The trial, called “SURPASS”, will be conducted in the following indications: urothelial cancer, melanoma, ovarian cancer, esophageal, esophagogastric junction cancer, gastric cancer, non-small cell lung carcinoma (NSCLC), head and neck, synovial sarcoma and myxoid/round cell liposarcoma (MRCLS).

Two Phase 1 clinical trials are ongoing with ADP-A2M10 for the treatment of (i) NSCLC, and (ii) urothelial, melanoma and head and neck cancers in the United States, Canada, the United Kingdom and Spain. These trials are first-in-human, open-label studies utilizing a modified 3+3 design in up to 28 patients with escalating target doses of 100 million (Cohort 1), 1 billion (Cohort 2), 5 billion (Cohort 3), and up to 15 billion (Expansion Phase) transduced SPEAR T-cells. Patients are currently being enrolled in the Expansion Phase in both trials. As of April 30, 2019 we had observed a decrease in target lesions in two lung cancer patients in the NSCLC trial (both patients having with a best overall response of SD). We have treated five evaluable patients in the triple tumour trial in Cohort 3 and the Expansion Phase, with two patients having a best overall response of SD and the remaining three patients having a best overall response of PD.

We continue dosing patients in our Phase 1, open-label, dose-escalation study designed to evaluate the safety and anti-tumor activity of our alpha fetoprotein (“AFP”) therapeutic candidate for the treatment of hepatocellular carcinoma (“HCC”). The trial is open in the United States, United Kingdom and Spain and is currently enrolling patients within the second dose Cohort at doses of 1 billion SPEAR T-cells. As of April 30, 2019 initial evidence of tumour necrosis has been seen in one patient in Cohort 1 and evidence of transient decrease in serum AFP and tumour shrinkage has been observed in one patient in Cohort 2. The patient in Cohort 1 has since progressed and the patient in Cohort 2 had stable disease at week 4. Most adverse events to date are consistent with those typically experienced by cancer patients undergoing cytotoxic chemotherapy or other cancer immunotherapies.

Non-clinical Pipeline

|

·

| |

We continue to develop our preclinical pipeline of SPEAR T-cells, with SPEAR T-cells to new targets and additional HLAs being developed. We are also developing multiple next generation approaches. |

|

·

| |

Adaptimmune presented data at ASGCT in May 2019 in relation to its allogeneic platform. The data presented indicate that mature T-cells can be generated from Human Induced Pluripotent Stem Cells (hiPSC) in vitro and that these mature T-cells can respond to cancer targets when transfected with SPEAR TCRs. This process is intended ultimately to be used to develop allogeneic or “off-the shelf” versions of our SPEAR T-cells. |

Manufacturing development

|

·

| |

Since the opening of our Navy Yard facility in January 2018, Adaptimmune can now manufacture cells for up to 10 patients per month for US clinical trials across a broad range of tumors. We continue to further develop and optimise our manufacturing process. |

|

·

| |

With respect to vector, Adaptimmune is developing its own vector manufacturing process and has completed its first engineering run with first GMP production anticipated in 2019. We also have vector production in place at a third-party vendor. |

GSK Collaboration Agreement Programs

|

·

| |

The NY-ESO SPEAR T-cell program was transitioned to GSK in August 2018 at which point GSK assumed full responsibility for future research, development and potential commercialization of the NY-ESO T-cell therapy (now called GSK 3377794). |

|

·

| |

GSK nominated a second target program for the PRAME target antigen, which was announced on January 9, 2017. The program led to the development of a final lead candidate SPEAR T-cell directed to a specific peptide from the PRAME antigen. We and GSK agreed that the collaboration should not continue due to the peptide, to which the lead candidate was directed, not reaching GSK criteria. |

|

·

| |